What are Benchmark Rates?

Benchmark Rates are used in financial transactions throughout our economy and are an integral part of interest rate markets. All banks, including AIB, use them in the pricing of many products.

What are IBORs and why are they being reformed?

Benchmark Rates, such as IBORs have long been relied on by banks to set interest rates for lending. As they are key to the financial system, they have been subject to increasing regulation and review.

What are the alternatives?

New alternative reference rates are being proposed to replace IBORs. They include risk free rates which are based on transactions which have already taken place, making them more transparent and robust.

What are the alternatives?

New alternative reference rates are being proposed to replace IBORs. They include risk free rates which are based on transactions which have already taken place, making them more transparent and robust.

Who will be impacted by these changes?

All banks offering products based on IBORs will be affected. If you have a contract with us which relates to an IBOR this may need to be reviewed or amended depending on the final maturity date. If this is the case, we will communicate with you.

The Working Group on Sterling Risk Free Rates, the Bank of England, Financial Conduct Authority and other relevant regulators have regularly published guidance on the cessation of LIBOR products.

- No new GBP LIBOR based cash products, such as loans, maturing after 31 December 2021, were to be entered into after 31 March 2021.

- Alternative Reference Rates for certain IBORs should be in place by 31 December 2021, when banks will no longer be compelled to submit quotes for LIBOR.

- For GBP LIBOR lending products, the risk free rate replacing LIBOR is SONIA. Since 1 October 2020, we have offered a new product to facilitate market transition from GBP LIBOR to SONIA. This new product is used for:

-new GBP loans based on a market related rate and issued from 1 October 2020 onwards; and

-existing LIBOR based loans converting to SONIA by the regulatory deadline of 31st December 2021

- For USD LIBOR and CHF LIBOR lending products, the risk free rate replacing LIBOR is SOFR and SARON respectively. We launched new SOFR and SARON products in July 2021.

How will this guidance affect customers?

- AIB has not been actively selling GBP LIBOR since 30 September 2020

- Any new RFR products will not be on a precise 'like for like' basis with those currently in place. See our Transition Guide for more information

- Existing contracts which relate to an IBOR will need to be reviewed and amended depending on their final maturity date

- We will continue to communicate with customers where changes to products and/or documents are required

What are we doing to get ready for the change?

At AIB, we have devised a strategic transition plan, reviewed our systems and developed new products. We will continue to monitor and respond to how the market evolves and regulatory guidance, to work towards a smooth and effective transition.

What will happen next?

We are monitoring the situation, actively participating in industry forums, and will update this website as IBOR transition develops. If changes to products or documents are needed, we will communicate with you.

We recommend reading our IBOR Transition Guide for more information on the changes and next steps.

You are encouraged to seek independent advice (legal, financial, tax, accounting or otherwise), from your own professional advisors, based on your own particular circumstances.

You may also find the following IBOR Guide from UK Finance useful.

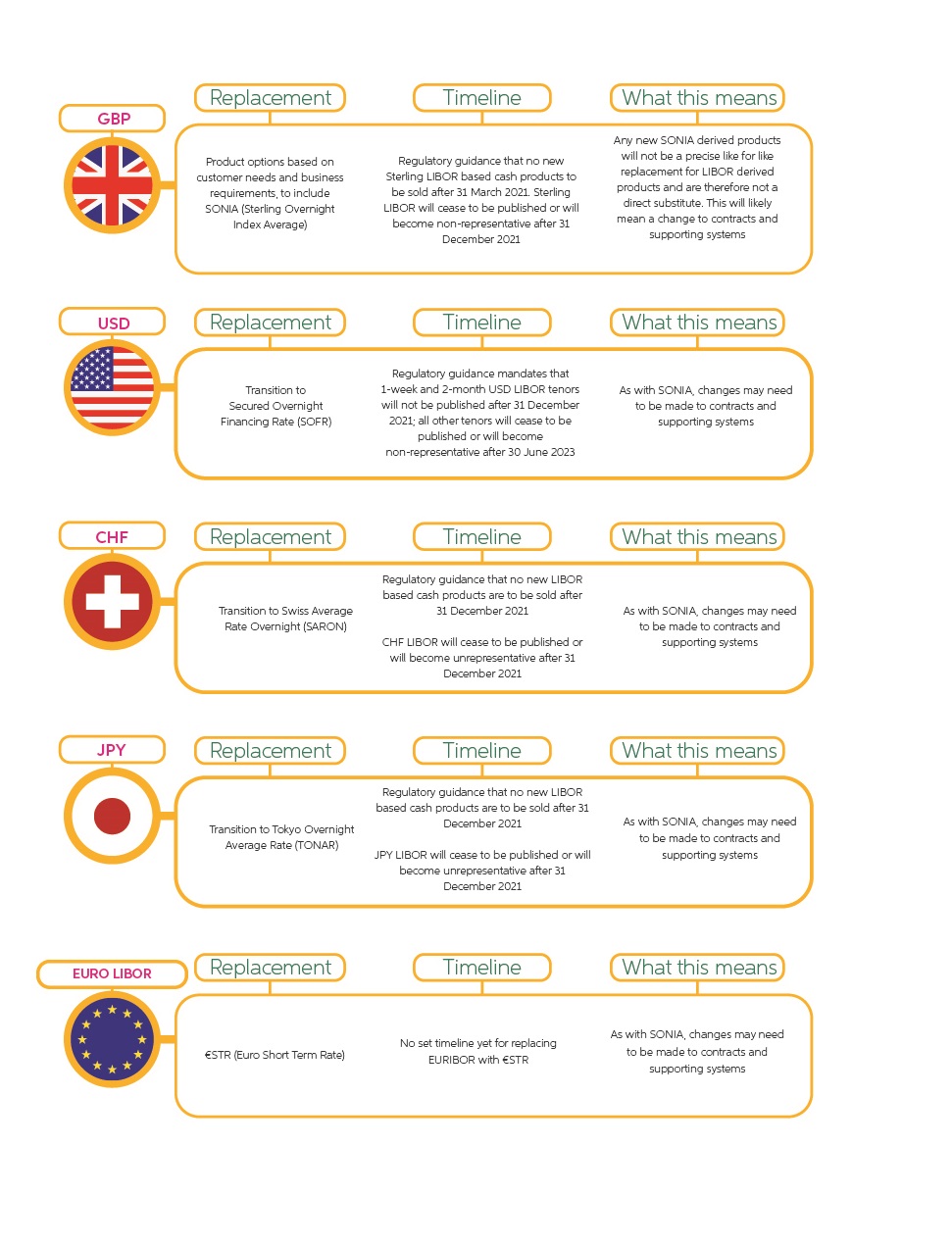

What alternative reference rates will replace IBORs?

There are also LIBOR rates in other currencies.

Frequently Asked Questions

-

What is a Benchmark Rate?

Benchmark Rates are used in financial transactions throughout our economy, for example, to calculate interest rates for loans.

-

What is IBOR?

Interbank Offered Rates represent an estimate of how much it would cost a bank to borrow money from other banks. IBORs are published in several currencies and for a variety of interest periods.

-

What are Risk Free Rates?

Risk Free Rates are a type of Alternative Reference Rate (ARR). They are overnight rates, based on transactions which have already taken place.

-

What are Alternative Reference Rates (ARRs)?

They are Benchmark Rates which are being developed as an alternative to IBORs.

-

Why are IBORs being replaced?

IBORs are based on forward looking estimates of how much it costs for a bank to borrow money from other banks in the interbank lending market. The activity in this market has been declining gradually. ARRs, such as Risk Free Rates, are being introduced because they are based on transactions which have already taken place in markets which are very active, making them more accurate and robust.

Disclaimers

This guide is provided for information only and may not represent the views or opinions of AIB Group (UK) p.l.c. or its affiliates (collectively, the AIB Group), employees or officers. The information contained in this guide does not constitute and shall not be construed to constitute legal, tax and/or accounting advice by AIB Group (UK) p.l.c.. AIB Group (UK) p.l.c. makes no representation as to the accuracy, completeness, suitability or timeliness of such information, which may also be subject to change. This guide may only be accessed by recipients lawfully entitled to do so.

This guide and any documents provided with it should not be used or relied upon by any person/entity (i) for the purpose of making investment or regulatory decisions, (ii) to provide regulatory advice to another person/entity based on matter(s) discussed herein or (iii) in connection with any transaction, contract or communication.

Any terms set forth herein are intended for discussion purposes only and are subject to the final terms as set forth in separate definitive written agreements. This guide is not a commitment or firm offer and does not oblige us to enter into such a commitment, nor are we acting as a fiduciary to you.

Any transaction which you may enter into with AIB Group (UK) p.l.c. will be on the basis that you have made your own independent evaluations, without reliance on AIB Group (UK) p.l.c., and based on your own knowledge and experience and any professional advice which you may have sought in relation to all aspects of the transaction including, without limitation, legal, accounting and/or tax advice.

Recipients of this guide should be aware of statements made by the Financial Conduct Authority and other international regulators, that LIBOR will cease to be published between now and the end of 2021. We encourage you to understand how the provisions of your product(s) with AIB Group (UK) p.l.c. and any linked products will operate should LIBOR or other applicable benchmarks be discontinued, have their use restricted, if any published benchmark rate ceases to be in customary market usage, or if there are changes to the way in which the benchmark is calculated, and bear in mind that amendments to your contract and any contract for linked products may be required in the future.

AIB Group (UK) p.l.c cannot give any assurances that LIBOR or any other benchmarks will continue to be published or give any assurances as to the likely impact (including on the value, price or performance of your product), costs or expenses associated with any resulting transition. If you are in any doubt as to the impact of these reforms, you are encouraged to seek independent advice (legal, financial, tax, accounting or otherwise), from your own professional advisors, based on your own particular circumstances.

In no event will AIB Group (UK) p.l.c. be liable to you or any third party for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising whether in contract, tort (including negligence), breach of statutory duty, or otherwise, arising out of, or in connection with, your use of (or failure to use) any information provided in this document.

We encourage you to keep up to date with the latest regulatory and industry developments in relation to IBOR transition and to consider its impact on your business. You should consider, and continue to keep under review, the potential impact of IBOR transition on any existing product you have with AIB Group (UK) p.l.c., any new product you enter into with AIB Group (UK) p.l.c., and any other products you hold.