A range of competitive options to maximise your funds with the flexibility you need.

Whether you are looking to put some surplus capital away for a fixed term, or need to retain access to your lump sum, Allied Irish Bank (GB) has a deposit account that’s right for your business. So you can get a great return on your money, along with exceptional customer service and the flexibility you need.

We offer two types of Deposit Accounts for businesses:

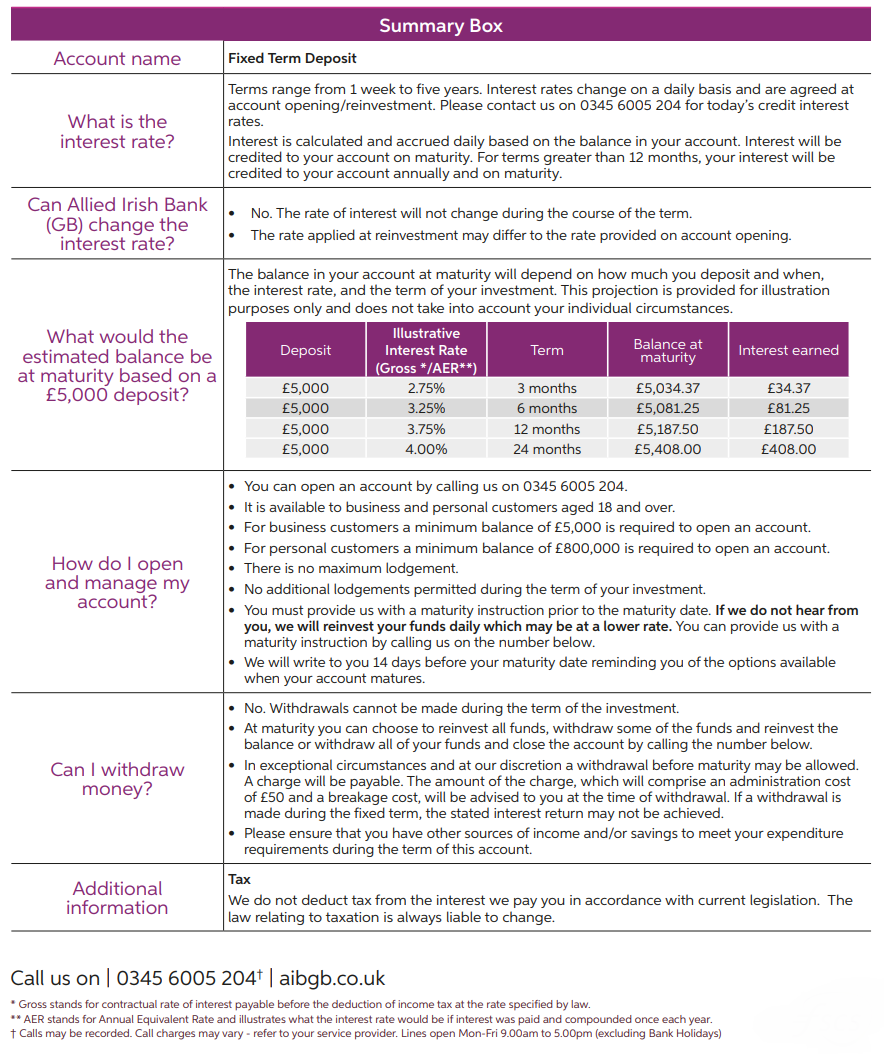

1. Fixed Term Deposit Account

If you can put your lump sum away for a fixed period of time, without accessing it, you’ll earn a higher rate of interest on your money with our Fixed Term Deposit Account.

- Features and Benefits

Fixed Term Deposit Summary Box

This summary box sets out important information that applies to our Fixed Term Deposit account. You should carefully read this document along with the Fixed Term Deposit account Terms and Conditions to allow you make an informed decision as to whether this product is right for you.

If you require this summary box in PDF format, please download here

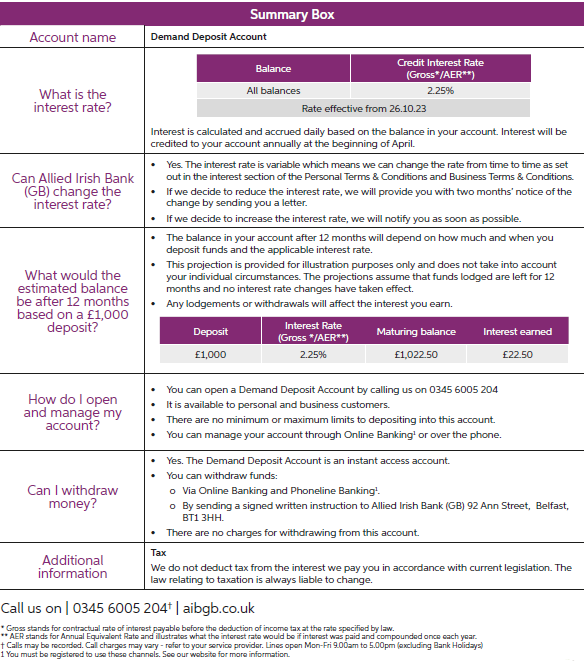

2. Demand Deposit Accounts

With a range of Demand Deposit Accounts from Allied Irish Bank (GB), you can earn a regular interest income on your surplus capital, while retaining flexible and instant access to your funds.

- Features and Benefits

Demand Deposit Summary Box

This summary box sets out important information that applies to our Demand Deposit Accounts. You should carefully read this document along with the Demand Deposit Account Terms and Conditions to allow you make an informed decision as to whether this product is right for you.

If you require this summary box in PDF format, please download here

Talk to Us

If you are an existing customer, you can speak directly with your Relationship Manager to learn more about getting the best return on your surplus capital.

Please note: For deposits greater than £500,000 contact our Corporate Deposits specialists on 02890 821025 †.

† Lines open: Monday – Friday 09:00 – 17:00 (except on bank holidays). Calls may be recorded. Call charges may vary - refer to your service provider.

Help and Guidance

Help Centre

For all service related queries please visit our Help Centre.

Other Information

Independent Credit Ratings

Financial Services Compensation Scheme