Convert sales to cash quickly and boost your working capital

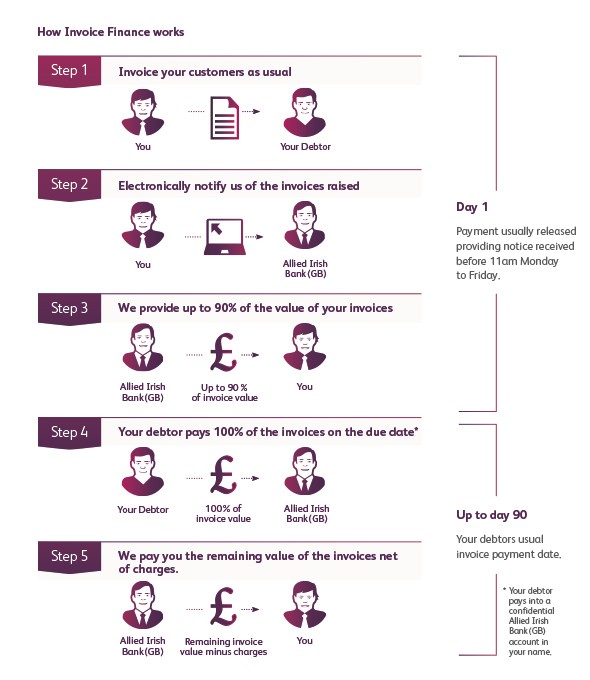

Invoice Finance from Allied Irish Bank (GB) is an asset-based debtor finance solution to your working capital needs. With Invoice Finance, we provide your business with an upfront release of up to 90% of funds tied up in unpaid invoices. So you can stay competitive by quickly converting sales to cash, maintaining a healthy cash flow and paying your suppliers in full and on time.

- Features and benefits

- How it Works

- Costs

Talk to Us

Simply call +44 (0)345 600 5204. We’ll be happy to answer any questions you might have about applying for Invoice Finance with Allied Irish Bank (GB)

† Lines open: 9am to 5pm Monday - Friday (except on bank holidays). Calls may be recorded. Call charges may vary - refer to your service provider.

Help and Guidance

Help Centre

For all service related queries please visit our Help Centre.

Important Information

Availability of credit depends upon our assessment of your financial position. We encourage you to take independent legal advice to ensure that you understand your commitment and the possible consequences of your decision.

Please note that security and insurance may be required