Latest security alerts

At Allied Irish Bank (GB) we are committed to protecting you against the threats associated with internet and other types of fraud. Here, you will find details of specific current security threats to our customers and alerts that you should be aware of.

Current Security Alerts

At Allied Irish Bank (GB) we take security seriously. We aim to protect you against the threats associated with internet fraud. Here, you will find details of specific current security threats to our online banking customers and alerts that you should be aware of.

Fraudulent text messages:

Criminals are texting customers claiming to be from official organisations offering a grant/funding to help with rising energy costs. These texts may include a link to a fake website asking customers for their card details or Online Banking details to receive support.

Sharing your details may allow a fraudster to steal your money rather than giving you money.

You should check with these organisations independently whether this is a legitimate text message, and contact us if you have already shared your details and are concerned.

Remember, NEVER share your Online Service details or codes from your Card Reader with anyone, not even bank staff.

Fraudulent Whatsapp and text messages:

Criminals are contacting customers via text or WhatsApp from an unknown number, claiming to be a family member and encouraging you to transfer money to cover an urgent bill.

This is backed by a story that a family member has recently changed their phone or phone number and may ask you to replace the old number with the new one.

Always make sure you speak directly to the family member who is asking you to send funds to an account you have not used before. If you are suspicious in any way, do not engage with them and delete any communication you have received.

Fraudulent texts:

Criminals can make fake text messages look like they come from us. They can even insert these fake messages into genuine text conversations we are having with you.

One way of spotting a scam is that our web address will have .co.uk at the end. If it has any other ending like .com, it is definitely a scam.

Be careful and never click a link in a text message - even if it appears to be part of a conversation with us. We don't put links into our text messages.

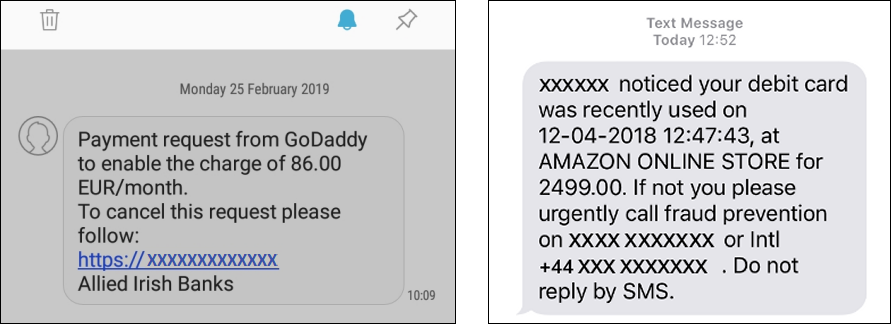

Here are some examples of fraudulent texts pretending to come from us:

If you believe you have received a fraudulent text message, email or phone call, please send a copy of the details here.

For further information to protect yourself against fraud, visit Take Five.

Fraudulent phone calls:

Criminals can call you pretending to be us. They can even mimic our phone number. But remember:

- We will never text you a One Time Passcode to cancel a transaction.

- We will never ask you to get a code from your Card Reader to cancel a transaction.

- We will never ask you not to log back into your account.

- You should not share a One Time Passcode code or Card Reader code with anyone if you get an unexpected call or text message, whoever they say they are, even if they say they are from our fraud team.

- We will never call you to ask for a code we have sent to you, or to ask why you didn't complete the process in the text message.

These codes are the way to make money leave your account. Never share them with anyone including bank staff

If you believe you have received a fraudulent text message, email or phone call, please send a copy of the details here.

For further information to protect yourself against fraud, visit Take Five.

SCAM ALERT: Coronavirus

Fraudsters are using the publicity around the Coronavirus to pose as genuine organisations, including bank staff, government and/or health service officials. They are claiming to help keep your money safe, or to offer investment and / or medical advice at a cost.

Remember: AIB or other organisations, such as law enforcement agencies, will NEVER ask you to transfer money, move it to a safe account, nor ask you to disclose your security credentials, personal or financial information by phone, email or text message.

For more information: https://takefive-stopfraud.org.uk/news/scam-alert-coronavirus/

Phone Scam Warning

We are aware that fraudsters are contacting customers of AIB (NI) / AIB GB along with other banks requesting security details or asking customers to transfer money.

We would remind you that our staff will never ask for your security credentials or to transfer money.

Text Message Fraud Warning |

Fraudsters are currently targeting members of the public via text message to divulge sensitive and personal banking details. These text messages are fraudulent, but can be inserted into existing and genuine AIB NI / AIB (GB) text streams, and in some cases the fraudster will call the customer directly afterwards. AIB (NI) / AIB (GB) will;

Examples of fraudulent text messages

In some cases, fraudsters can call you after sending a warning message from a number that appears to be from AIB (NI) / AIB (GB). If you have concerns over a call you received that appears to be from AIB (NI) / AIB (GB), please end the call and then phone the number on the back of your card directly, this will bring you to a genuine AIB (NI) / AIB (GB) staff member. If you have clicked a link, telephoned the number quoted in a text message or email, or have received a suspicious phone call and divulged any personal or account information please contact us immediately on the number on the back of your card. You do not need to contact us or take any action if you have not acted on or received the fraudulent text message. A genuine text message or phone call from AIB (NI) / AIB (GB) will never ask you for full passwords, activation codes, passcodes, card reader codes, credit card details, financial information or ask you to transfer funds to a ‘safe account’ either with AIB (NI) / AIB (GB) or another financial institution. |

Allied Irish Bank (GB) phone scams

Allied Irish Bank (GB) have been notified of a Phone Scam currently targeting our customers. Reports received to the Bank indicate that:

- Fraudsters purporting to be from Allied Irish Bank (GB) have been targeting customers asking them to make test payments from their account.

- Callers claim that they are calling on behalf of Allied Irish Bank (GB) and can fake the caller identification to make it look as if the call is from a legitimate source.

Allied Irish Bank (GB) reminds customers to be vigilant and aware of such calls - they are not genuine.

- Allied Irish Bank (GB) never requests you to make payments from your account to any account.

- Allied Irish Bank (GB) never requests you to provide your security details.

- If you suspect that a call may be fraudulent, or are unsure about the source of a call please hang up and call Allied Irish Bank (GB).

TalkTalk/BT vhishing scams

We have seen an increase in telephone vhishing scams, with fraudsters claiming to be from telecoms providers such as TalkTalk and BT and offering a refund. If you receive a call like this, hang up and call the provider back on a number you can verify. Do not give the caller remote access to your PC, and do not log into your Online Banking if instructed to do so by the caller.

If you feel you have been affected by this type of fraud or any other scam, call our customer service advisers on 028 9034 6034 (8:30 to 17:00 Mon to Fri) or email us here.

Man-in-the-middle vishing alert

Fraudsters are committing man-in-the-middle vishing scams to exploit genuine bank account details and security information which enables them to make unauthorised payments to bank accounts under their control.

How it works:

Generally, victims are contacted by a text, letter or email purporting to be from their bank, which requests that the victims contact them on a telephone number provided.

The victim phones the number provided, and the suspect then redirects them to the bank; however as the call has been redirected, the criminals have the ability to record and listen to this call as it is being made, gaining all the victim’s security answers and personal detals.

The criminals then phone the bank at a later date purporting to be their customer and exploit the genuine credentials and security information gained to request a range of payments to be made from the account(s).

Prevention advice:

- Never provide personal or financial details to an unsolicited caller.

- Always contact us on a trusted number found on our website or correspondence that is known to be authentic, such as a statement. Do not call the number provided on the text, letter or email without first confirming that it belongs to us.

- If you have concerns about the validity of the caller, please hang up and contact us to request confirmation of any possible communication made by us, prior to giving out any personal details.

If you feel you have been affected by this type of fraud or any other scam, call our customer service advisers on 028 9034 6060 (8:30 to 17:00 Mon to Fri) or email us here.

Phone Call Scam Warning

The bank is receiving reports that fraudsters are calling customers trying to persuade them that their computer/laptops are operating slowly. The criminals are attempting to get customers to agree to pay a nominal charge to fix the problems and they then trick them to make a payment for a much higher value.

Have you received a call asking any of the following questions?

Is your PC operating very slowly?

Will you pay a fee to get it fixed?

Do you want them to logon remotely to your PC to fix it?

This is a Fraud Scam do not log on to Online Banking to make any payments to them.

Hang up and report the call to our customer service advisers on +44(0)28 9034 6060† or email us here.

† Lines open: 8.30am to 5pm Monday - Friday (except on bank holidays). Calls may be recorded. Call charges may vary - refer to your service provider.

.png)