Please note: this account is currently unavailable to new customers

Choose a fixed term to get secure rewards on your money

If you have a lump sum to save and you know that you can put it away for a fixed term, then you can benefit from the security of a fixed rate of interest. Savings Direct Fixed Rate Bonds are available to our existing Savings Direct personal customers only and can be operated by post or phone.

If you currently have a Savings Direct 7 Day Notice Account or Savings Direct Easy Access Account with Allied Irish Bank (GB), you have the opportunity to switch your funds (minimum of £5,000) to a Savings Direct Fixed Rate Bond.

- Savings Direct Fixed Rate Bond Features and Benefits

- How it Works

- Tax on interest earned on Savings Direct Fixed Rate Bonds

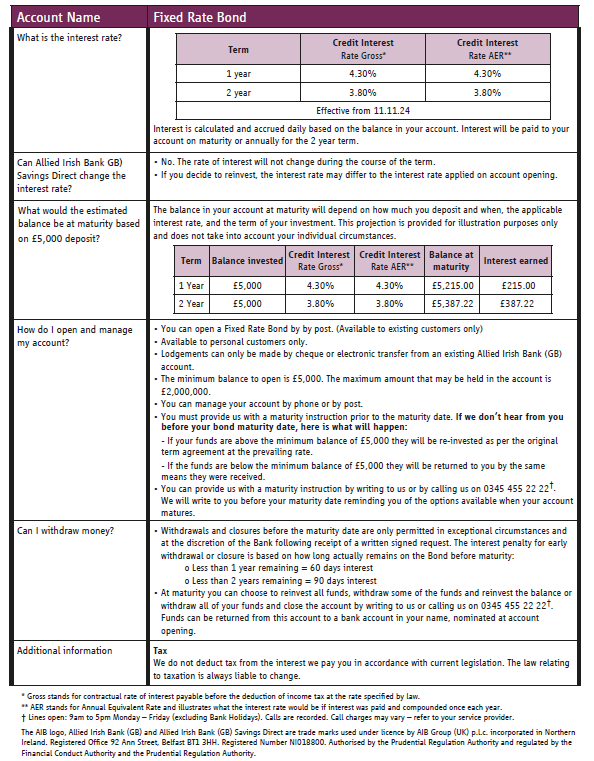

Savings Direct Fixed Rate Bonds Summary Box

This summary box sets out important information that applies to our Savings Direct Fixed Bonds account. You should carefully read this document along with the Savings Direct Fixed Bonds Terms and Conditions to allow you make an informed decision as to whether this product is right for you

If you require this summary box in PDF format, please download here

Talk to Us

If you are an existing Savings Direct customer with an existing account and want further information please call. Call +(0)345 455 22 22† if from the UK or +44 (0) 203675 1437† if calling from overseas to talk to our Customer Service Team. We’ll be happy to answer any questions you might have about Savings and Deposits with Allied Irish Bank (GB).

† Lines open: Monday – Friday 09:00 – 17:00 (excluding Bank Holidays). Calls may be recorded. Call charges may vary - refer to your service provider.

Help and Guidance

HMRC (HM Revenue & Customs)

The HMRC is responsible for the collection of taxes and duties in the UK.

Downloads

Terms and Conditions

View the Savings Direct Easy Access Account Terms and Conditions.