Online and Phoneline Banking Help FAQs

Time and Date Stamp

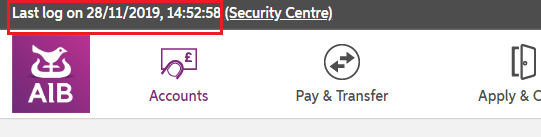

Each time you log in to Online Banking we will display the details of your last log in.

This is an additional security measure that we have taken to ensure that you know if someone has fraudulently accessed your accounts online.

The details shown are the date and time on which you last accessed the service. It is important that you check your last log in every time you log in. It will be displayed in the top navigation bar as indicated below.

If you are suspicious of the last log in shown and do not recall logging in to Online Banking on that date, please contact our customer service advisers for assistance at the following number:

Allied Irish Bank (GB): 028 9034 6060 (08:30 to 17:00 Mon to Fri)

Direct debits FAQs

You can now view your direct debits online and cancel those that are no longer required.

- What is a direct debit?

- What are the fees associated with direct debits?

- What is displayed when I select the 'direct debit' option?

- Can I set up a direct debit using Online Banking?

- Can I amend a direct debit using Online Banking?

- How do I cancel a direct debit using Online Banking?

- How do I view all the details of an active direct debit on an account?

- How long does it take to cancel a direct debit using Online Banking?

- Why are certain details missing on my list of direct debits?

- How can I initiate a Direct Debit Indemnity Request