Choose a fixed term to get secure rewards on your money.

If you have a lump sum to save and you know that you can put it away for a fixed term of 6, 12 or 24 months, then you can benefit from the security of an attractive fixed rate of interest.

- Features and Benefits

- How it works

- What happens on Maturity (at the end of the term)?

- Important Information

- Tax on interest earned on Fixed Rate Saver Accounts

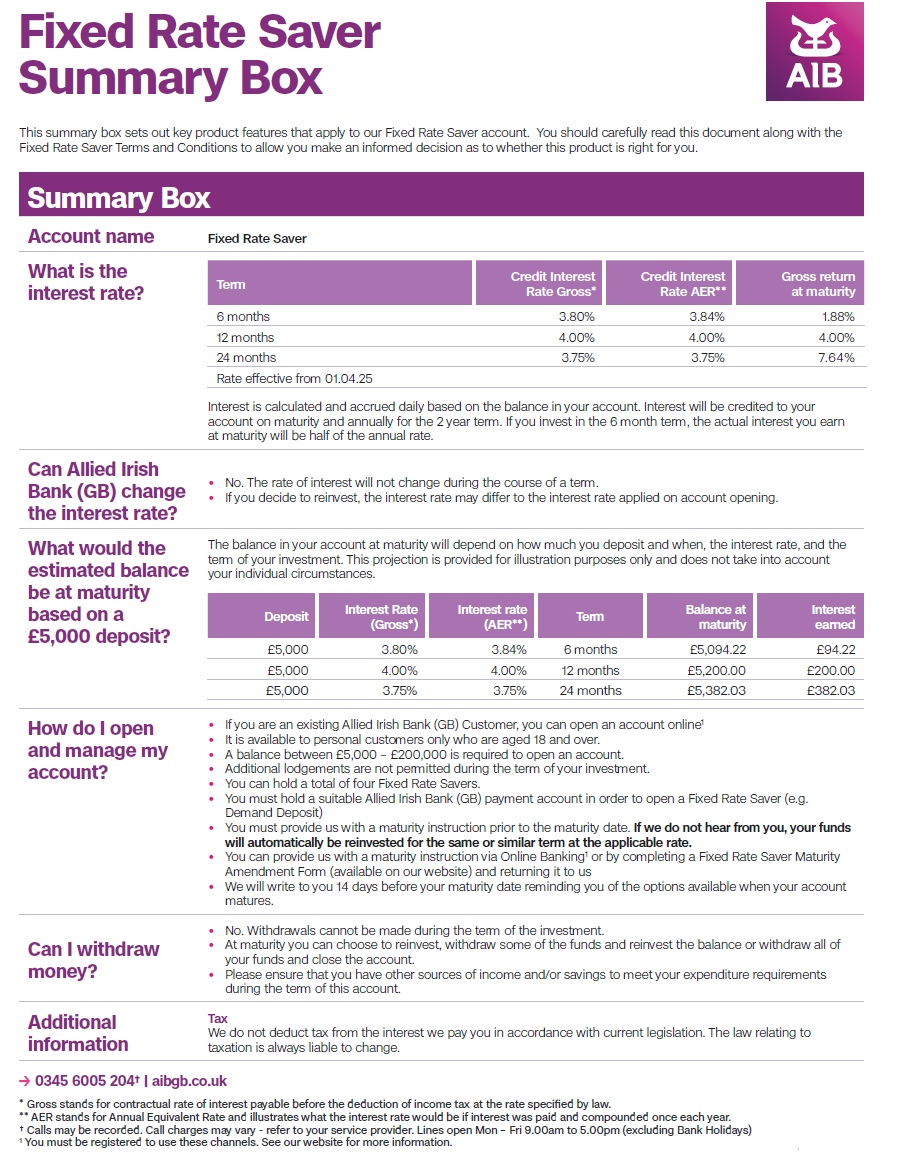

Fixed Rate Saver Account Summary Box

This summary box sets out important information that applies to our Fixed Rate Saver account. You should carefully read this document along with the Fixed Rate Saver Terms and Conditions to allow you make an informed decision as to whether this product is right for you.

Talk to Us

If you are an existing customer, you can speak directly with your Relationship Team, or call us on (0)345 600 5204†.

Please note you must be a UK resident to open an account with us.

† Lines open: Monday – Friday 09:00 – 17:00 (except on bank holidays). Calls may be recorded. Call charges may vary - refer to your service provider.

Help and Guidance

HMRC (HM Revenue & Customs)

HMRC is responsible for the collection of taxes and duties in the UK.

Income Tax on Interest

From the 6 April 2016 credit interest on all accounts will be paid gross (under new legislation tax will not be deducted when credit interest is paid). If your credit interest is more than your Personal Savings Allowance you may still have tax to pay. Please see www.gov.uk for information on the Personal Savings Allowance or speak to a tax advisor.